Folks, In all fairness and with Reform already put to get America out of Economic Recession, recovery plan put in place took a little longer, but results have begun to show. Considering the overlaping 4 decades of mounting problems on fiscal debts President Obama inherited, to complete the recovery, President Obama should be given a second chance so to complete the work he started. President Obama is Passionate and enthusiastic to complete the task for Reform he begun.......he can be trusted and for sure, lets give President Obama all votes so he can get down to work and complete what he begun to make America strong and the most successful championing the best competitiveness on the face of the world, unlike Mitt Romney who is outsourcing and shipping jobs overseas making the country weak and vulnerable from joblessness........These are indicators and signs that Mitt Romney cannot be trusted, he will make the situation worse than where we came from in the first place........ Spread the word and help each other to go vote.......Go Vote with clear concious. The earlier you go to the polls the better you are and Vote for President Obama..!!! Judy Miriga Diaspora Spokesperson Executive Director Confederation Council Foundation for Africa Inc., USA http://socioeconomicforum50.blogspot.com Remember - Obama for America TV Ad Published on Oct 27, 2012 by BarackObamadotcom Share this: http://OFA.BO/Whhi3x Mitt Romney and Paul Ryan plan to end Medicare as we know it Published on Aug 15, 2012 by BarackObamadotcom Share this: http://OFA.BO/HLwUnn Republican Women for Obama Published on Aug 24, 2012 by BarackObamadotcom Learn more: http://OFA.BO/WbWDgC Women for Obama Uploaded by BarackObamadotcom on Nov 20, 2007 Obama 2012: Are you in? http://my.barackobama.com/womenvid President Obama Speaks on College Affordability Published on Jun 7, 2012 by whitehouse President Obama calls on Congress to stop interest rates from doubling on student loans, and discusses his Administration's initiatives to keep college affordable for students and their families. June 7, 2012. The trick to the middle class is not to borrow money to go to college. College used to be a ladder up, now you owe the bank on graduation day. If you can't get a good job, the loans default, and a low wage job is not going keep up with the loan interests. If college was free like it was for baby boomers, you got a chance at the middle class. The baby boomers closed the door for the next generation. Colleges are asking for annual costs from students the equivalent of a new Mercedes Benz. Reform College costs are out of control, I just graduated and I feel sorry for people who have to enroll now. Maybe if interest doubled students would take their academic path more seriously instead of going to college just cause they feel its something they should do. Collage is not always the right path for everyone. President Obama Engages with Youth with Disabilities Published on Aug 23, 2012 by whitehouse Recently, President Obama met with some youth with disabilities. He wanted to hear their thoughts about the future of disability policy. So, he sat down with participants from the American Association of People with Disabilities internship program. These young people are passionate and strong representatives for millions of people with disabilities across the country. They represent a brighter future for America. President Obama is ready to stand with them each and every day. Helping America Become a Grad Nation Uploaded by whitehouse on Mar 1, 2010 President Obama is joined by Secretary of Education Arne Duncan and General Colin Powell as he announces plans to help reduce dropout rates and prepare students for college and careers. March 1, 2010. White House Science Fair Uploaded by whitehouse on Oct 18, 2010 President Obama speaks about the importance of science, technology, engineering and mathematics education to the country's economic future after viewing exhibits from science fair winners from across the country. October 18, 2010. Obama hits Romney on Wall Street, Medicare, educationWhite House CorrespondenThe Ticket – 3 hrs ago NASHUA, N.H. - President Barack Obama's re-election campaign released a harsh new ad Saturday that accuses Republican rival Mitt Romney of looking to roll back regulations on Wall Street, turn Medicare into a voucher system, and slash education funding. The 30-second ad cast the incumbent in a defensive light -- someone fighting to hold onto cherished programs, not to propose new reforms. Romney's campaign hit back, with spokeswoman Amanda Henneberg saying "we can't afford four more years like the last four" and predicting that voters would pick Romney's "positive agenda over President Obama's increasingly desperate attacks." The Obama commercial, set to run in Florida, Iowa, Ohio, and Virginia, distills Obama's main argument for re-election: That the former Massachusetts governor will gut programs that help the middle class in favor of wealthy Americans and big banks. "Mitt Romney's plan rolls back regulations on the banks that crashed our economy. Medicare, voucherized. Catastrophic cuts to education. Millionaires will get one of the largest tax cuts ever. While middle class families pay more. That's what Mitt Romney wants to bring here. Remember that when you go here." Polls suggest that Romney has the edge among voters on which candidate would better revive the still-sputtering economy, while Obama leads on who would better defend middle-class interests. The president has spent months trying to paint his rival as an out-of-touch multi-millionaire, while Romney has portrayed his huge success as an investor as evidence he is the better candidate to spur growth. In a sign of how important this battle is to Obama's political fortunes, the president also used his weekly address from the White House to underline those themes, charging that Republicans hope to "delay, defund, and dismantle" legislation imposing new rules on Wall Street in the aftermath of the 2007-2008 global financial meltdown. "To make sure America never goes through a crisis like that again, we passed tough new Wall Street reform to end taxpayer-funded bailouts for good," he said. "That's what Wall Street reform is all about — looking out for working families and making sure that everyone is playing by the same rules," said Obama. "Sadly, that hasn't been enough to stop Republicans in Congress from fighting these reforms. Backed by an army of financial industry lobbyists, they've been waging an all-out battle to delay, defund and dismantle these new rules," he said. "I refuse to let that happen." "We've come too far — and sacrificed too much — to go back to an era of top-down, on-your-own economics," he said, in a line that sounded ripped straight from his stump speech. Obama has also strived recently to emphasize upbeat economic news (while never forgetting to highlight that he inherited a crisis from George W. Bush). "Our businesses have added more than 5 million new jobs. The unemployment rate has fallen to the lowest level since I took office. Home values are rising again. And our assembly lines are humming once more," he said in his weekly address. "The president's campaign is once again trying to cover up for his lack of an agenda to help the middle class," said the Romney campaign's Henneberg. "Mitt Romney and Paul Ryan are offering real change for a real recovery, with 12 million new jobs, rising incomes, and a stronger middle class." Obama was holding a rally in New Hampshire, whose four electoral college votes are seen as up for grabs, as well as record a radio interview set to run in the Granite State on Tuesday. He was also to do radio interviews set to run in Miami, Fla. and Cincinnati, Ohio.

Obama up 4 percentage points over Romney in OhioThe Ticket – 23 hrs ago A new CNN/ORC poll of likely voters shows President Barack Obama leading Republican nominee Mitt Romney in the crucial state of Ohio with less than two weeks before Election Day:

Before the poll's release, Romney's Ohio state chairman, Sen. Rob Portman, had stopped just short of saying Ohio would be a must-win for the Republican challenger. "If we don't win Ohio, it's tough to see us winning the election nationally," Portman had told NBC News.

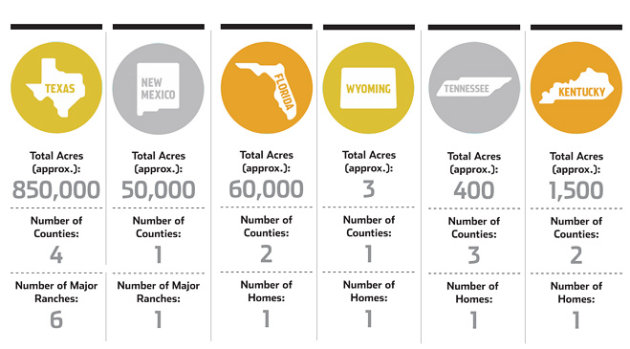

Billionaire Holds Navy Ship HostageBy Lee Ferran | ABC News – 17 hrs agoSo you're a super-rich American investor and a large South American country owes you $1.6 billion, which it refuses to pay in full. You can take a partial settlement that others have taken - which reportedly would get you just 30 cents on the dollar - or you could do something a little more drastic and, say, seize a high-profile naval vessel belonging to the offending country. What do you do? Such was the real-world problem facing billionaire Paul Singer before he decided on option B, and his company convinced a small African nation to seize Argentina's Libertad frigate. As reported by Bloomberg.com, the ship's seizure is the latest salvo in a standoff between Singer, a hedge fund kingpin and one of the largest GOP donors this election season, and the government of Argentina. The two have been locked in a global dispute over the reported $1.6 billion debt claim that resulted from the country's nearly $100 billion default a decade ago. Caught in the middle this time is the historic frigate ARA Libertad and the West African nation of Ghana. The stately, three-mast ship was seized three weeks ago after it docked in Ghana, where a local court ruled the ship could be held on behalf of NML Capital, a subsidiary of Singer's investment group, Elliot Management Corp. More than 300 Navy sailors stayed with the ship until the Argentinean government ordered them to abandon it earlier this week. They returned home Thursday. Top Argentinean officials have reportedly accused the Ghanaian government of violating rules of diplomatic immunity and likened NML Capital's actions to a " vulture fund" involved in international extortion. In a "Braveheart"-worthy declaration earlier this week, Argentinean President Cristina Kircher said on national television, "They may keep our frigate, but not our freedom." Argentina's Foreign Minister, Hector Timerman, said Thursday he was confident the nation would get its ship back without negotiating with NML Capital, noting that such seizures had happened before - an astounding 28 times. Today the Buenos Aires Herald listed several notable seizures including the grounds of the Argentinean ambassador's residence in the U.S. in 2004 and the president's private jet in 2007. Each were eventually returned. The frigate is estimated to be worth just 1 percent of the outstanding debt, Bloomberg reported. As ABC News previously reported, Singer has made a name for himself in the high-dollar game of political donations. He has donated millions to Republican candidates in the last two election cycles but his most important role may be as a "bundler" for Presidential candidate Mitt Romney. He helped Romney raise $5 million with a single Manhattan fundraiser in May. Bloomberg reported the Libertad's sailors were flown out of Ghana on a French commercial jet. Apparently the Argentinean government was afraid that if any Argentinean assets were sent to retrieve them, they too would be seized. A call for comment on this report from Elliot Management Corp were not immediately returned. Representatives for NML Capital, which is listed on its website as being based in Cyprus, also did not immediately return after hours requests for comment. The Man With a Million AcresOct. 26th 2012 He's from Kentucky, makes his own bourbon, drives a Ford pickup—and flies in a private plane. These are some of the few details that have emerged about Brad Kelley, 55, a deeply private billionaire who made his fortune in the discount cigarette business. Mr. Kelley, whose hobbies include breeding rare, exotic animals, very rarely gives interviews. He doesn't tweet or use email. He is also one of the largest private landowners in the country, spending by his own account hundreds of millions of dollars on about a million acres—or about 1,600 square miles. The state of Rhode Island, by comparison, has a land area of 1,215 square miles. According to the Land Report 100, which tracks land ownership, Mr. Kelley is the fourth-largest private landowner by acres in the U.S., just behind Liberty Media Chairman John Malone, media mogul Ted Turner and the Emmerson family, headed by timber magnate Archie Aldis Emmerson. Mr. Kelley says it wasn't his goal to become one of the country's biggest landowners. "I grew up on a farm and that's about as good an explanation as there is," he says in an interview. "Land is something I know. It's something I have an affinity for. It becomes part of your DNA." It has also become an increasingly popular investment in uncertain financial times. Some investors see land as a hedge against inflation, and low global interest rates have made land cheaper to buy. Higher world food prices and an anticipation of a recovery in the housing market have bankers pitching land as one of the few places to get real returns on an asset whose underlying value continues to rise. "It's a nonperishable commodity and it's as good a place as any to put my money," Mr. Kelley says. "It's better than derivatives." Dennis Moon, head of the Specialty Asset Management team at U.S. Trust, the private-banking division of Bank of America (BAC), says land appeals to people as an investment they can easily understand. His clients have more than doubled their direct investments in irrigated farmland—land that produces crops like corn, soybean and wheat—over the past year to about $175 million, earning a net yield of some 4% a year. Others are more cautious, warning that the high rate of growth could mean the market is in a bubble, the risks being volatility in agricultural commodity prices, farmland values and farm production costs. Ranches, which are Mr. Kelley's specialty, don't tend to yield much of an annual return. Instead, their value is in the underlying appreciation of the land: According to the U.S. Department of Agriculture, the national average value of U.S. ranchland rose 12% compared with five years earlier; in Texas, it is up 30% compared with five years ago. Investors make cash on ranches when they are subdivided and sold to developers or as "trophy ranches," where the wealthy can fish and hunt. Texas oil baron T. Boone Pickens describes his strategy with ranches as "simple: Change the use of the land." He recently joined six other investors in a new ranch fund called Sporting Ranch Capital. The plan, says the fund's manager Jay Ellis, is to buy 12 to 15 premier ranches in Colorado, Wyoming, Montana, Oregon and Idaho, fix them up and then resell them as "trophy sporting ranches." In August, the fund made its first purchase—a 760-acre ranch in Colorado with a 2.6-mile fishing stream and five lakes—for about $6 million in cash; the fund hopes to put it back on the market in 2014 for over $10 million.  Source: The Wall Street Journal Source: The Wall Street Journal Mr. Turner first got into buying ranches in 1987 for the fly fishing and stress relief. "I fell in love with the West; the wide-open spaces, the wildlife and beautiful landscapes. I knew immediately that I wanted more land—and lots of it," he says in an email. But he also tries to make his ranch operations—most often raising bison—profitable. "We always consider investment value in addition to opportunities for recreation and conservation when we look at property," he says. Mr. Kelley's ranch strategy is different. He looks for good deals on cattle ranches in out-of-the-way places he thinks are undervalued, and holds on to them. He likes to buy adjoining parcels because it's more efficient to operate a ranch in large blocks and because it tends to be easier to buy property when it's right next door: He already knows what he's buying and what the seller is like. And he doesn't develop the land he buys: "We don't try to inject our way of doing things on other folks," he says. In this way, he has pieced together existing cattle ranches in remote parts of Texas, Florida and New Mexico. Once he has bought the land, Mr. Kelley does what some ranchers call "resting." He keeps the cattle operations running, almost always leasing the land back to the previous owner, who already knows how to run the existing operation. Mr. Kelley says his operations break even. Several farmers and ranchers who work on land owned by Mr. Kelley didn't respond to requests for interviews. The value of Mr. Kelley's land investments is difficult to calculate. "When he started buying ranches here, we all thought he was crazy," says Johnny Carpenter, an Alpine, Texas, real-estate agent who sold Mr. Kelley about half a dozen ranches in West Texas over a five-year period. Since then, the value of the land Mr. Kelley owns in those areas, known to be scenic with views of mountains, has doubled, Mr. Carpenter says. Chip Cole, a ranch broker in San Angelo, Texas, who was involved in the sale of about 15 ranches to Mr. Kelley, says prices doubled in 2005 and 2006. In 2008, sales volume dried up, making estimating current values more difficult, though Mr. Cole suspects values have softened. Few things make Mr. Kelley bristle more than being called a land speculator. He argues that he has sold about 15% of his total holdings over the past three decades; combined with the land he has bought, that's an aggregate turnover of less than half a percent, most of it for management reasons. "We take great pride in improving our property," he says, adding that he replaces and upgrades dozens of miles of fences annually and keeps water and wells running. People who have worked for Mr. Kelley recall him showing up at his ranches with groups of friends and family for occasional hunting and fishing weekends. At night, the group played cards and drank bourbon. Homer Mills, who started working for Mr. Kelley in West Texas in 1999 and helped him manage the dozen or so ranches he bought over the next five years, describes Mr. Kelley as a "good old boy from Kentucky." He recalls that Mr. Kelley sometimes wore a kilt ("they're comfortable," says Mr. Kelley when asked), liked cooking (he made a "mean cornbread," says Mr. Mills) and didn't hunt, though he did fish. At one point Mr. Kelley sported a long red beard, earning him the nickname "ZZ Top." Colorful eccentricities aside, Mr. Kelley is also a shrewd businessman who avoids the limelight. Much of Mr. Kelley's land is listed under LLCs with names like Spanish Trail Land & Cattle Co. and Texas Mountain Cattle Co. Brokers say they often deal with his business manager, an attorney named Greg Betterton, who works out of an office in Venice, Fla. "You don't call Brad Kelley. He calls you. People all over the South try to get land in front of him. He's been one of the most effective people at flying below the radar in this space," says Joe Taggart, a managing director with LandVest, a real-estate and timberland-consulting firm based in Boston. Mr. Kelley grew up in Franklin, Ky., near the Tennessee border, on a tobacco farm that also had livestock and a little grain. He always assumed he would become a farmer, he says. He bought his first piece of land—a farm with cattle near his childhood house—in 1974 when he was 17, shortly after graduating from high school. He dropped out of Western Kentucky University four times and never graduated.

Iron Mountain Ranch, about 30,000 acres northwest of Marathon, Texas. (Bill Murphree) As the tobacco industry shifted in the 1980s and the business of preliminary tobacco processing began to decline, there were a number of old warehouses around Kentucky that were no longer being used. Mr. Kelley got into the business of buying them and converting them for other uses, leasing them out to businesses like furniture and paper processing. One day, in the process of removing old equipment from a warehouse, Mr. Kelley came across some old cigarette-making equipment that still worked. He had wanted to get into manufacturing consumer products, so he seized the opportunity. He started Commonwealth Brands, a small cigarette manufacturer based in Bowling Green, Ky., with discounted brands like USA Gold, Sonoma, Commonwealth, Country Value and a cigar called Brahman in 1991. He sold Commonwealth in 2001 to Houchens Industries, a Bowling Green, Ky.-based conglomerate, for about $1 billion. Mr. Kelley doesn't smoke. "I never defended it," he says of his old business. "Hopefully it will be phased out of society." Mr. Kelley began investing in land outside Kentucky in 1997. He was drawn to West Texas, where he says he now has about 850,000 acres, because prices were good and he found the land beautiful and out of the way, he says. Once he bought something, brokers started contacting him about buying more land. Mr. Kelley's foray into Florida began in 1997 with the purchase of a house in Boca Grande for about $1 million. He sold that and bought his current three-bedroom, 5,923-square-foot house, also in Boca Grande, in 2000 for $5.5 million. He was looking for property to set up a place for his animal breeding operations—a hobby that started with rare breeds of cattle, he says. That led to the acquisition in 2004 and 2005 of some 40,000 acres in De Soto County, in the western part of the state for a reported $50 million. Mr. Kelley now has a breeding operation on some of that acreage, known as Rum Creek Ranch, that's dedicated to a range of endangered species including tapirs, anoas (small buffalos), hippos, rhinos, bongos (antelopes), bentang (wild cattle) and a host of others. He works with zoos and conservation groups, with the ultimate goal of reintroducing the animals back to their native habitat. His primary home is in Franklin, Tenn., where he lives with his wife, Susan, and his three daughters. He bought his 8,176-square-foot house with a swimming pool and a tennis court on 26 acres in 2003 for $1.9 million. He frequently travels to his different properties, he says.He owns about 60 properties in Simpson County, Ky., where he grew up, as well as land in New Mexico, Wyoming and Colorado. Though he is still buying large pieces of land—mostly in Texas, where he purchased about 44,000 acres in adjoining cattle ranches over the summer, and Kentucky, where he bought the 800-acre Calumet Farm this spring—land only represents about a quarter of his businesjs interests. He owns some land in Chile and has looked at Argentina, but says there were too many transactional hurdles there. His other business investments are in venture capital in companies that range from telecommunications to construction materials, beer and energy technology. Mr. Kelley says he just takes opportunities as they come. "There's never been a grand plan. Life takes you a lot of places. Every day you adjust your compass," he says. |

Karibu Jukwaa la www.mwanabidii.com

Pata nafasi mpya za Kazi www.kazibongo.blogspot.com

Blogu ya Habari na Picha www.patahabari.blogspot.com

Kujiondoa Tuma Email kwenda

wanabidii+unsubscribe@googlegroups.com Utapata Email ya kudhibitisha ukishatuma

Disclaimer:

Everyone posting to this Forum bears the sole responsibility for any legal consequences of his or her postings, and hence statements and facts must be presented responsibly. Your continued membership signifies that you agree to this disclaimer and pledge to abide by our Rules and Guidelines.

0 comments:

Post a Comment