When IMF and the investment community say an economy is growing what they mean is that the claims they have to that economy's labor, land and natural resources are growing! It means they can now bet more money on the nation!

Money value is an illusion.

We should say no to foreign investment because the investor is KING! the borrower is SERVANT to the lender!

We can organize ourselves! we are the ones who have true capital - Land, Labor and Natural Resources. We should organize our capital to develop ourselves!

No great nation was ever developed with foreign investment.

On Sun, Aug 26, 2012 at 4:53 PM, Judy Miriga <jbatec@yahoo.com> wrote:

--

Forwarded for your information.......................

Judy Miriga

Diaspora Spokesperson

Executive Director

Confederation Council Foundation for Africa Inc.,

USA

http://socioeconomicforum50.blogspot.comAfrica and the BRICS formation

by IndepthAfrica | Posted on Thursday, April 19th, 2012Horace CampbellThe BRICS leaders have seen concretely that there is no alternative to moving from a unipolar world to a multipolar world that is based on mutual respect and an end to hierarchies.eme, 'BRICS Partnership for Global Stability, Security and Prosperity.' From the press reports coming out India, we have learnt that the leaders of Brazil, Russia India, China and South Africa signed two pacts to stimulate trade in their local currencies and agreed on a joint working group to set up a South-South Development Bank that will raise their economic weight globally.The participating banks for this new international financial struggle include the Export Import Bank of India, Banco Nacional de Desenvolimento Economico e Social (BNDES) of Brazil, State Corporation Bank for Development and Foreign Economic Affairs of Russia, China Development Bank and Development Bank of South Africa. At the end of the meeting the five leaders issued the 50 point Delhi Declaration declaring their intention to further strengthen "our partnership for common development and take our cooperation forward on the basis of openness, solidarity, mutual understanding and trust." [1]In our commentary this week we reflect on the seismic changes in the global economy and the reality that Europe has suffered so much from the capitalist crisis that the major capitalist corporations are making preparations for the collapse of the Euro. [2] With each passing day there are reports in the financial press that 'investors are taking huge sums out of eurozone bonds. [3] Where the BRIC leaders had started a formation to facilitate their expanded trading relationships, the collapse of the dollar zone and the Eurozone has accelerated so fast that the policy makers are now improvising without a clear road map as to a project of real international solidarity. To their credit, the BRICS leaders have seen concretely that there is no alternative to moving from a unipolar world to a multipolar world in the 21st Century that is based on mutual respect and an end to hierarchies. Yet, as we will argue in this extended commentary, the focus of the planning of the peoples of the South should no longer be on the basis of bargaining for better terms with western capitalist states. We will maintain that for genuine social and economic transformations to take place in these countries representing 45 per cent of the world's population, it will be necessary to make a clean break with the ideas of 'historic capitalism.' [4] Whether the BRICS formation will be the embryo of a 'new wave of independent initiatives from the South' or based on regional hegemons will be dependent on the extent to which the forces of social justice and emancipation engage the political and ideological struggles around BRICS. A 17 point action plan focused on issues relating to finance, health, population, food security and multilateral energy cooperation within the BRIC's framework provides spaces for a new research and policy agenda that could strengthen and consolidate the goals of a new framework for economic cooperation. In this way progressive scholars can give meaning to the call for the expansion of the channels of communication, exchanges and people-to-people contact amongst the BRICS, including in the areas of youth, education, culture, tourism and sports. [5]The current leaders of India aspire for a BRICS and the 'development bank' to be an auxiliary institution of the World Bank. Inside South America, Brazil is the society that is represented as a rising major power but the African descendants and the indigenous peoples in that society are involved in a major struggle for reparative justice. Temporarily, South Africa carries the torch for Africa within BRICS but we will analyze the limitations of this present arrangement arguing that the strength of BRICS will be realized in a context when new international formations such as BRICS have the full weight of African representation from a united peoples of Africa and a Brazil that is democratized to reflect the political representation of the majority of the Brazilian population. Ultimately, for BRICS to be a real alternative it will have to have a clear strategy about expansion so that the goals of building another world based on peace and real international solidarity can be realized.FROM REALISM TO BRICS AND UBUNTUWhen the financial analysts at Goldman Sachs wrote their forecasts on the future of the BRIC economics in 2003, "Dreaming With BRICs: The Path to 2050," [6] it was not in their calculation that in less than ten years the capitalist system would be in deep crisis and that the societies of the European Union would be on their knees with emissaries seeking bailout from China, Brazil and even African states. At the time of the 2012 Summit the New York Times grudgingly reported that, "Last November, Mr. O'Neill predicted that the group's combined economies, now worth almost $13 trillion, would double in the coming decade, eventually surpassing the size of the economies of both the United States and the European Union." [7] Opportunistically, the leaders of Britain are jockeying for London to be an offshore center for trade in the Chinese currency. With the news of the collapse of the Euro spooking the bond traders in Europe, a few days ago the bank HSBC announced that it was about to sell bonds denominated in the Chinese Currency (RMB or Yuan). European capitalists from the London capital markets are no longer waiting for a neat change in the property laws inside of China which would guarantee holding large amounts of Chinese currencies and assets.Today, the reality of a changed international system is evident and policy makers in all parts of the world are seeking to adjust to this new reality. Out of a force of habit from the past hundred years European and US policy makers seek to shape perceptions of the 'emerging countries' [8] and it is from their schools where there are scholars who pontificate on which society will be the hegemons in the next fifty years.Students who start from realist theories in international relations have studied ideas of strength and power for so long that in their analysis and calculation, there can be no other possibility than a world where there is one or two military 'superpowers.' Whether it is Henry Kissinger who in his book, 'On China,' envisages the dominance of China, (as long as it takes the capitalist path) or Zbigniew Brzezinski who envisage a new alliance between China and the United States in a Group of Two (so that the present Chinese political leadership can deepen their alliance with the plutocrats of Wall Street), realism and realist doctrines echo across the globe. From the United Kingdom, British scholars and journalists pontificate on the rise of China arguing that China's economic and political clout will only be realized when China embrace western 'democratic' values. [9] Robert Kaplan completes this realist tapestry by writing on the rivalry between China and the United States in the Indian Ocean. [10] From inside Chinese Universities and think tanks leading realist scholars such as Professor Yan Xuetong of Tsinghua University and Wang Yizhou, Vice Dean School of International Studies at Peking University ponder on the need for the Rise of China in order to end the dominance of United States or the U.S.-led world order." These Chinese institutions now produce books and monographs on the Rise of China and fete scholars who write books such as that of Martin Jacques, When China Rules the World: The End of the Western World and the Birth of a New Global Order. [11]When I attended the 11th annual conference on Chinese diplomacy in Beijing last December, it was striking how much emphasis the realists were placing on the future relationship with the United States as if there were no other important regional formations. It was left to by Le Yucheng, Assistant Minister and Director Policy Planning, Ministry of Foreign Affairs to highlight the new importance of BRICS for Chinese foreign policy. In his keynote address "Current International Situation and China's Foreign Affairs" le Yucheng grasped the importance of BRICS and communicated this, especially in the context of financial crisis in Europe, the revolutionary change in Egypt and the diminution of the dollar. Thus far, because of the intellectual and political retreat from Marxism and Maoism in China, the political leaders have been supporting the ideas of Confucius, "that everyone should know their place in social hierarchies." Many of the top intellectuals within the political establishment of China who seek to trace their lineage to their proper place in the social hierarchy of China prior to 1949 do not factor in the international crisis of capitalism in their analysis of the new global order.It is in India where the perverse idea of social hierarchy has been institutionalized in a caste system to the point where these ideas hold back the full potential of all of the peoples of India. Realist scholars in India respond to the end of the US dominance by holding on to a vision where the ideas and policies of the United States can form the basis for an alliance between the Indian ruling class and the United States to 'balance' the rise of China. Although touted as a 'rising economy,' India has been the largest recipient of World Bank loans. This alliance between the Indian governing class and the Bretton Woods Institutions ensured that in his address to the BRICS Summit, the Prime Minister of India, Manmohan Singh said that, BRICS need to "expand the capital base of the World Bank and other Multilateral Development Banks to enable these institutions to perform their appropriate role in financing infrastructure development." [12] There is a wider intellectual canvas in India with younger scholars recognizing the need to go beyond neo-realism in international affairs. There are major political and social struggles all over India with some of these struggles militarized. Scholars such as Sreeram Chaulia have written on need for the refinement of theories relating to South-South Cooperation. In the dominant centers of International Relations theories there is great fear of theoretical frameworks that start from a radical feminist perspective.Russia has retreated from all ideas of building an egalitarian society and is now suspended between its socialist past and its oligarchic present. Russia is already in a formation with China called the Shanghai Cooperation Organization (SCO) and recently carried out joint military operations with China. Russia is one of the societies which is still reeling from destructive dismantling of the planned economy. [13] while in Brazil the intellectual struggles are as intense as the political struggles for democratization for that society to break out of racial hierarchies. Russian scholars have been very active in calling for a clear role for BRIC in articulating the construction of a new international order. [14] In the emerging global order, the majority of the peoples of the South are seeking new relations beyond the reproduction on new 'superpowers.' [15] Inside Brazil, the majority of the peoples are struggling for a form of democratization that repairs the centuries of destruction and genocidal economics. Foremost among these peoples are those of African descent at home and abroad who are seeking to move to a new philosophical basis for international politics, one that harnesses the resources of the planet to lay the foundations for peaceful relations. It is here where the philosophy of Ubuntu holds promise in proposing a different priority from the old ideas of strength, power, military might and the 'development of the productive forces.'In 2011 South Africa was invited by China to its summit on the Chinese island of Hainan and South Africa became the fifth member of BRIC. When South Africa became the full member there were a number of choices before the South Africans, either reproducing realist ideas that South Africa was the strongest economy in Africa, a regional hegemon and hence logically entered the club of the 'emerging powers' or pushing for BRICS to engage questions of peace, health and the environment to break the preoccupation with 'trade and development' It was the South African struggle that popularized the ideas of Ubuntu but since the coming to power of the African National Congress (ANC), the political leaders have embraced the ideas of capitalist development while posturing as defenders of African freedom. The memory of the self-organization of the popular classes in the anti-apartheid struggle is still fresh in the minds of the people so the political leadership cannot jettison the ideas of African liberation. More importantly, it was this anti-apartheid struggle that gave birth to new forms of internationalism.

Thus, while progressive Pan Africanists hail the emergence of BRICS as a possible alternative to neo-liberal hegemony, the planet will not have shaken the shackles of oppression by opposing US financial dominance and replacing it with multilateral neo-liberal cooperation between rising capitalist states in Brazil, Russia, India, China and South Africa. The progressive African point of view on the emergence of BRICS is now being demanded as more and more there are initiatives coming from BRICS such as the formation of a development bank.REVISITING THE EVOLUTION OF BRICS AND THE BUILDING OF A FAIRER WORLDVladimir Shubin, Institute for African Studies, Russian Academy of Sciences (one of the intellectual holdovers from the era of socialist solidarity) has been one of the more engaging scholars from the BRIC countries who has shed some light on the thinking behind the leaders of BRIC in their invitation to the South Africans to become a member of BRIC. In his paper "BRIC or BRICS," Shubin, a leading authority on the relationship between Russia and the liberation movements in Africa, wrote of South Africa's aspiration to be part of a 'core of nonwestern powers.' [16] Shubin's writings are useful in so far as we are exposed to some of the thinking outside of western Europe on the evolution BRICS and the overlapping relations of the IBSA Dialogue Forum. During the height of the struggles over intellectual property rights in the World Trade Organization (WTO) and the future of generic medicines, India, Brazil and South Africa (IBSA) had established the IBSA forum as a platform to engage in discussions for cooperation in the fields of agriculture, trade, culture, and defence among others. One of the top priorities of IBSA was for the democratization of the Security Council of the United Nations and for the end to the veto power of the five permanent members. These three states had an interest in becoming permanent members of the Security Council displacing France and Britain. Neither China nor Russia is enthusiastic about the democratization of the Security Council of the United Nations.South Africa's ability to exercise any real leadership within IBSA was circumscribed by the proclamation of the New Partnership for Africa's Development (NEPAD) strategy for Africa's economic transformation. Numerous African scholars have written extensively on how World Bank 'development' ideas were at the foundation of this NEPAD. [17] These critiques of NEPAD and the Millennium Development Goals (MDG) are instructive in so far as the leaders of the BRICS formation continue to maintain that the outmoded MDG goals "remain a fundamental milestone in the development agenda." For the past ten years NEPAD was another foreign policy instrument for South African capital. Throughout Africa imperial economists have been able to recruit African technocrats who have been as energetic as the Bretton Woods institutions in promoting 'economic structural adjustment programmes.' These liberalization projects have been labeled as 'economic terrorism.' This economic terror has taken the form of a sustained attack on the living standards of the African peoples and the clear deterioration of the quality of life that has brought into being a new political consciousness in Africa. In all parts of Africa citizens have to do with little or no access to the basic necessities of clean water, health care, decent education and housing. Neo-liberalism and structural adjustment strengthened the alliance between the African ruling classes and the imperial overlords so that IMF and World Bank fundamentalism ensured that the profitability of enterprises took pride of place before human lives.African governments have embraced neo-liberal exploitation without the direct involvement of the international financial institutions' such as the IMF and the World Bank. In this way, leaders in societies such as India and the majority of African states will continue to serve the interests of global capitalism. Globalization gave unprecedented mobility for the lords of finance so they were not worried about national boundaries. What was most important was that 'development' serves the interest of the one per cent. This would include reproducing one per centers in the BRICS societies. In the discourse of the financial barons, 'development' was supposed to be in the hands of experts and should exclude the skills, consciousness and capabilities of the producing classes. This kind of 'development' (according to the Walt Rostow model) was for the demobilization and depoliticization of the people who fought for independence.Time was not standing still and by 2008 when the full blown capitalist crisis exploded, then there were new initiatives to create other international formations. It was just after the crash of Wall Street in 2008 when the first official multilateral conference of Brazil, Russia, India and China met in June 2009 in the Russian City of Yekaterinburg. Previously, in 2006 the foreign ministers of the four countries had met unofficially in the city of New York, followed by a meeting at diplomatic level in Yekaterinburg in May 2008. The declared objective of the first summit of BRIC was spelt out by the Russian President Dmitry Medvedev who said: "The BRIC summit aims to create the conditions for the building of a fairer world order and the creation of a favourable environment for resolution of global problems. At the same time, we must not overlook our national problems and objectives, which are priorities for all of us, of course, priorities for all the respective leaders and governments" [18] One could see from the declaration that there had not been much thought given to what would constitute a 'fairer' world order.The second summit of BRIC was held in Brasilia, Brazil in 2010 where the same 'reform' agenda echoed as the final communique. The leaders called for reforming financial institutions. It was in the context of the flurry of meetings of the G20 meeting in 2010 in Seoul, South Korea when South Africa was formally invited by the Chinese to attend the third summit of BRIC which was to be held on the Chinese Island of Hainan in April 2011. This summit took place at the height of the NATO bombing of Libya but apart from the statements of condemnation in the communique there were no strong pressures to rally the international community against the manipulation of the Resolutions of the Security Council of the United Nations on responsibility to protect. The Chinese and the Russians took cover from making any grand statement by arguing that South Africa had voted to support the UN resolution while the two permanent members had abstained.The final communique from the SANYA, Hainan meeting declared,"Leaders of the five fast-growing emerging economies vowed to support the reform and improvement in international monetary system for the establishment of a stable, reliable and broad-based international reserve currency system."The international financial crisis has exposed the inadequacies and deficiencies of the existing international monetary and financial system." [19]This declaration was being overtaken by the collapse of the old financial architecture. Before the end of 2011, the importance of BRICS as an alternative international formation was manifest by legations from the European Union travelling to China and Brazil seeking bailout for the Euro. The collapse of the European alternative to the dollar narrowed the choices before the countries of BRICS and it is this reality that should shed light on the call for BRICS to establish a development Bank at the end of the fourth summit in New Delhi.REJECTING WAR AGAINST IRANThe focus on financial relations and on creating new basis for economic relations overshadowed the burning international questions of the drumbeats of war in the Persian Gulf and the continued build-up of US military presence in Asia-Pacific and in Africa. We do not know if the leaders of BRICS discussed the question of the aftermath of Libya because Libya was not mentioned in the press reports. It was from Cuba in the last year where in a conference with intellectuals Fidel Castro was in a discussion where it was said that in all parts of the world those who want peace must discuss Libya. In particular, it was discussed that there should be international opposition to the killing of Africans in their own country and calling them mercenaries as is the case for the township of Tawerga. [20]We do know that during the last year Russia attempted to reconvene the UN Security Council to discuss the killing of innocent Africans who were deemed to be 'African' mercenaries in an African country. Collectively, the leaders of BRICS do not support the bellicose postures toward Iran and these leaders understand the long term goals of Israel and the militaristic wing of US capital. This was manifest in a strong and forthright statement that,"The situation concerning Iran cannot be allowed to escalate into conflict, the disastrous consequences of which will be in no one's interest. Iran has a crucial role to play for the peaceful development and prosperity of a region of high political and economic relevance, and we look to it to play its part as a responsible member of the global community. We are concerned about the situation that is emerging around Iran's nuclear issue. We recognize Iran's right to peaceful uses of nuclear energy consistent with its international obligations, and support resolution of the issues involved through political and diplomatic means and dialogue between the parties concerned, including between the IAEA and Iran and in accordance with the provisions of the relevant UN Security Council Resolutions."BRICS AND THE CALL FOR A NEW DEVELOPMENT BANKWhere the final communique of the fourth BRICS summit was short on recommendations for a clear statement on the 'colossal failure of NATO in Libya, it was robust in the call for a new development bank. The objective of the BRICS bank will be to scale up intra-Brics trade which has been growing at the rate of 28 per cent over the last few years. We are informed in a missive from New Delhi that, "Brics sign 2 currency pacts."This article informed us that at US$230 billion, interBrics remains much below the potential of the five economic powerhouses. Brics has set a target of interBrics trade to be US$500 billion by 2015. For this purpose there was the directive for the setting up of a BRICS Development bank. The BRICS Delhi Declaration said that, "The bank is being envisaged to mobilise "resources for infrastructure and sustainable development projects in Brics and other emerging economies and developing countries, to supplement the existing efforts of multilateral and regional financial institutions for global growth and development." The leaders directed their finance ministers "to examine the feasibility and viability of such an initiative, set up a joint working group for further study, and report back to us by the next summit", said the declaration.This move to develop a complimentary institution to supplement the existing efforts to the International Monetary Fund and the World Bank contains all of the contradictions inherent in the ideation system of those who want to catch up and surpass the West. Progressive Pan Africanists yearn for the weakening of the financial hegemony of imperialist states of the Anglo-American world and are searching for levers to break the stranglehold of the Washington Consensus. In every part of Africa there is awareness that there is need for massive infrastructural investment (roads, rail, ports, Information and Telecommunications, air transport, energy and power generation, canals and water management) that will strengthen inter African trade and break the deformed patterns of extraction of resources. However, Africans will be vigilant to ensure that the 'development' plans of BRICS do not reproduce the five decades of 'development' that Africa has witnessed since independence.The Indian Prime Minister was explicit about the kind of development that he had in mind when in his speech he argued that the BRICS development Bank will be a supplementary institution to the World Bank. Progressive grassroots movements and intellectuals in the global South have been explicit in calling for an alternative to the priorities of the World Bank. Already, the Export Import Bank of China and the China Development Bank spends more money in the developing world than the World Bank. The Financial Times reported that in 2009 China spent over US $108. Billion while the World Bank spent US $100.3 b. This shift in the source of development funds is most explicit in Africa where according to information from the Exim bank of China, in the last year China invested more than US $35b in Africa. What must change are the priorities of these investments.Dr Sreeram Chaulia, a leading Indian scholar of International Relations gave some indication of the thinking in India that went into the proposal for a development bank. Chaulia in arguing that the World Bank and the IMF have outlived their usefulness suggested that the new Development Bank of BRICS should be patterned after the Bank of the South that has been explicit in its opposition to 'development' plans based on neo-liberal ideas. Chaulia argued that,"The concept of an intergovernmental bank paralleling or opposing the World Bank and operating on different ideological and procedural bases is not novel, as there is already a 'Bank of the South' (Banco del Sur) in existence in Latin America. It is a monetary and lending organisation with seven member countries, including Brazil, and a modest seed capital of $20 billion. Its mere presence has carved an autonomous space. India's motive and selling point in advancing the proposal for a Brics bank is, likewise, that the Bretton Woods institutions have historically failed to meet the developmental requirements of the Global South and that alternatives can now be erected on the shoulders of rising powers within the South, which have accumulated vast capital reserves. It would be a financial revolution if the proposed Brics bank is integrated with the Bank of the South in Latin America through the common bridge of Brazil. Brics must avoid dangling the threat of launching a new bank only to win some more representation within the World Bank and the IMF. The Brics bank must not become a mere bargaining ploy which could be shelved if more voting rights were given to the five emerging economies in western-led international financial institutions. A bank for the entire Global South should be non-negotiable, so that Least Developed Countries (LDC) keep faith in emerging powers who are growing at a much faster rate." [21]THE AFRICAN UNION AND THE BRICS BANKI have quoted Chaulia extensively because I agree that the formation of BRICS must not become a bargaining ploy for Chinese and Indian leaders to better their relationship with western financial capitalists. From the experiences of NEPAD and the Development Bank of South Africa (DBSA), African progressives can have no confidence in the present political leaders in South Africa to promote an agenda which is for the benefit of Africans in general and not South African capitalists. It is here where it is imperative that progressive and patriotic Africans work harder for the full harmonization of economic relations within the African Union so that the future of BRICS will be anchored in an international environment where the African representation in BRICS will be on behalf of Africa as a whole.The struggles to make the 'investments' of BRICS more accountable must be engaged within South Africa so that the neo-liberal priorities of the present government must be reversed. Thus, in the short run, while South Africa carries the banner of Africa within BRICS, the political leadership in South Africa must be held accountable so that the investment strategies do not replicate the destructive investments that have been championed by the South Africans with the World Bank. The financing of the coal fired plant in South Africa is but one example of the need for a wider discussion on the investment strategies of the future BRICS bank. Africa should not be a dumping ground for old technologies that are destroying the environment. France is busy seeking to align with China to sell nuclear reactors to South Africa.In a recent book, To Cook a Continent, African scholars have been warning about the dangers and consequences of the destructive forms of extraction of resources from Africa. The proposed BRICS bank will be put on notice that Africans will be vigilant to see that Chinese, Russia, Brazilian and Indian conglomerates operate in ways that respect Africans as humans. African workers are organizing against capitalists from BRICS that seek to reproduce low wage environments with the absence of the rights of workers. Africans will not replace plunder from western capitalists by new extractive capitalists from the East and from Brazil. Importantly, African progressives will not support another financial institution that facilitate capital flight from Africa. BRICS can move decisively to ensure that it is committed to the principle of the return of stolen assets and reparations.UBUNTU IN INTERNATIONAL RELATIONS – BEYOND CONFUCIAN HIERARCHIESThe African peoples have a clear sense of the need for a new Development Bank to supplant the IMF but this financial institution cannot be based on the ideas of Walt Rostow or Henry Kissinger. Samir Amin was very clear as to the new kind of social transformation that must be in tandem with this 'development.'

"Development cannot be reduced to its apparently major economic dimension- the growth of GNP and the expansion of markets(both exports and internal markets)- even when it takes into consideration the 'social' dimensions (degrees of inequality in the distribution of income, access to public services like education and health). 'Development' is an overall process that involves the definition of political objectives and how they are articulated: democratization of society and emancipation of individuals, affirmation of the power and autonomy of the nation in the world system." [22]This was the principle of development and social progress as it was articulated by the Bandung project. Imperialism fought to roll back this project of the autonomy of societies and nations in the world system. It was in Africa where this counter revolutionary energy was fed by white supremacy so Africans will strategize for the building of a new international system. This system cannot be based on a Confucian principle of hierarchies or an Indian caste system. In the medium term, if BRICS is to be the anchor of a new social order, it must have a strategy for a phased expansion.Africans will support BRICS while they are fighting against oppression at home and abroad. Africans welcome the idea of linking up with the bank of the South in so far as it is in Latin America where the struggles against neo-liberalism and racism are most advanced. In Argentina the radical initiatives in relation to an assertive role of the Central bank and the nationalizing of foreign oil companies is now making headlines. The struggles of African descendants in Latin America have brought issues of racism and racial discrimination out in the open. It is in Brazil where the African descendants constitute the majority of the population where this struggle is most intense. The fight against racism in Brazil is going on at the same time when Africans are working hard to strengthen the African Union. It is the convergence of these two struggles which will influence the outcome of Dreaming with BRICS the path to 2050. In this way the future of BRICS will be linked to a multipolar world that is against all forms of oppression. This would expose the caste systems of Russia, China and India and be pushed by the same alliance that promoted Ubuntu in the African Liberation struggles.Ubuntu emphasizes linked humanity and our intrinsic connection with a complex universe. The processes of 'development that we have seen over the past thirty years have reinforced the forms of production and consumption that is speeding the destruction of the planet earth. Although in the communique the leaders of BRICS affirmed the concept of a 'green economy,' the language of 'sustainable development' and 'economic growth' point to the old forms of economic industrialization that has brought the world to a tipping point. The carrying capacity of the planet cannot sustain a mode of capitalist economic development that mimics the forms of human organization of Western Europe and North America. China and India argue that they are developing countries in fora that deals with climate change but want to continue the destructive forms of economic management. Ubuntu opens the space for us to understand how different parts of the universe fit together, with an understanding that "everything is connected to everything else." As temporary inhabitants of the physical space on earth, we begin to appreciate the reality that the biosphere is the global ecological system integrating all living beings and their relationships, including their interaction with the elements of the cooperating systems (atmosphere, geosphere, and hydrosphere).We are entering the era of the bio-economy and the idea of a BRICS development bank must have as its first priority the health and safety of the planet and the health and safety of humans everywhere.Horace Campbell is Professor of African American Studies and Political Science at Syracuse University.END NOTES[1] Fourth BRICS Summit – Delhi Declaration, Ministry of Foreign Affairs, India, March 29, 2012

[2] Andrea Felsted, "Companies make plans in case the euro collapses", in Risk Management, Financial Times Special Report, April 16 2012, p.2.

[3] David Oakley, "Investors taking huge sums out of eurozone bonds", Financial Times, April 17 2012, p.21

[4] Samir Amin discusses the challenges of ending historic capitalism in the book, Ending the Crisis of Capitalism or Ending Capitalism? Pambazuka Books, Oxford, 2011

[5] Delhi Declaration, No.49

[6] Goldman Sachs, 2001. Dreaming With BRICs: The Path to 2050. London,

[7] Jim Yardley, "For Group of 5 Nations, Acronym Is Easy, but Common Ground Is Hard"

[8] Roberts, Cynthia. 2011. Building the New World Order BRIC by BRIC. The European Financial Review, Spring issue, pp.4-8.

[9] Jonathan Fenby, Tiger Head, Snake Tails: China today, how it got there and where it is heading, Simon & Schuster, New York 2012. This line of argument is reproduced by Will Hutton, The Writing on the Wall: China and the West in the 21st Century, Little, Brown & Company, New York 2007

[10] Robert Kaplan, "South Asia's Geography of Conflict, Council For Foreign Relations," New York, September 2011

[11] Martin Jacques, When China Rules the World: The End of the Western World and the Birth of a New Global Order, Penguin Press, 2012

[12] http://pmindia.nic.in/content_print.php?nodeid=1156&nodetype=2

[13] Kotz, David M, "Russia's Financial Crisis: The Failure of Neoliberalism?" Z Magazine, January, 1999, 28-32., See also David Harvey, The New Imperialism, Clarendon Press Oxford, 2003

[14] Davydov, Vladimir. 2008. The Role of Brazil, Russia, India & China (BRIC) In the Construction Of the International Order. Megatrend Review, vol.5, (1), pp.85-97.

[15] Brazil As an Economic Superpower?: Understanding Brazil's Changing Role in the Global Economy, edited by Leonardo Martinez – Diaz and Lael Brainard, Brookings Institute, Washington 2009

[16] Vladimir Shubin, "BRIC or BRICS?" Paper presented at the Nordic Institute of African Studies, 2011

[17] There have been well developed critiques of NEPAD by scholars within Africa. See J.O. Adesina," NEPAD and the Challenge of Africa's Development: Towards the Political Economy of a Discourse," African Journal of International Affairs, Volume 1 No.2, 2001. See also Samir Amin, "The Millennium Development Goals: A Critique from the South," Monthly Review, Volume 57, Issue 10, 2006

[18] See Speech by the Russian President DMITRY MEDVEDEV at the BRIC summit, June 16, 2009

[19] China Daily, BRICS leaders issue Sanya Declaration, (Xinhua), April 14, 2011

[20] Fidel Castro Talk with Intellectuals: Our Duty is to struggle.

[21] Sreeram Chaulia, "Better coordination needed among Brics nations on international political issues," Economic Times, March 21, 2012

[22] Samir Amin, Ending the Crisis of capitalism or Ending Capitalism? Pambazuka Press, 2011, Page 131BRIC/BRICS

By Matt Rosenberg, About.com Guide

See More About:A sightseeing ship on the Huangpu River against the night skyline of Pudongs Lujiazui Financial District on April 15, 2010 in Shanghai, China. China is one of five countries known as BRICS.

Getty ImagesAds

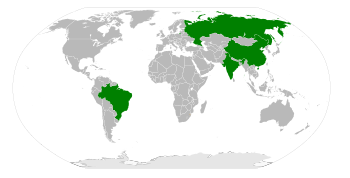

Goldman Sachs: InsightsInsights from Goldman Sachs on the Growth Markets in 2012www.goldmansachs.comDepression StudyWe're currently enrolling for our depression research study.www.depressionstudies.com(5) Signs of DepressionThese 5 Signs of Depression Will Shock You. See the Causes Now!Depression.DailyLife.com/5-SignsDefinition: BRIC is an acronym that refers to the economies of Brazil, Russia, India, and China, which are seen as major developing economies in the world. According to Forbes, "The general consensus is that the term was first prominently used in a Goldman Sachs report from 2003, which speculated that by 2050 these four economies would be wealthier than most of the current major economic powers."In March 2012, South Africa appeared to join BRIC, which thus became BRICS. At that time, Brazil, Russia, India, China and South Africa met in India to discuss the formation of a development bank to pool resources. At that point, the BRIC countries were responsible for about 18% of the world's Gross Domestic Product and were home to 40% of the earth's population. It would appear that Mexico (part of BRIMC) and South Korea (part of BRICK) was not included in the discussion.Pronunciation: BrickAlso Known As: BRIMC - Brazil, Russia, India, Mexico, and China.Alternate Spellings: BRIC, BRICS, BRIMC, BRIMCS (?)Examples:The BRICS countries include more than 40% of the world's population and occupy over a quarter of the world's land area. Brazil, Russia, India, China, and South Africa together are a powerful economic force.BRIC

From Wikipedia, the free encyclopediaJump to: navigation, searchNot to be confused with BRICS.

It has been suggested that this article or section be merged with BRICS and Group of Five. (Discuss) Proposed since July 2012. In economics, BRIC is a grouping acronym that refers to the countries of Brazil, Russia, India and China, which are all deemed to be at a similar stage of newly advanced economic development. It is typically rendered as "the BRICs" or "the BRIC countries" or "the BRIC economies" or alternatively as the "Big Four".The acronym was coined by Jim O'Neill in a 2001 paper entitled "Building Better Global Economic BRICs".[1][2][3] The acronym has come into widespread use as a symbol of the shift in global economic power away from the developed G7 economies towards the developing world. It is estimated that BRIC economies will overtake G7 economies by 2027.[4]According to a paper published in 2005, Mexico and South Korea were the only other countries comparable to the BRICs, but their economies were excluded initially because they were considered already more developed, as they were already members of the OECD.[5] The same creator of the term "BRICS" coined the term MIKT, that includes Mexico and (South) Korea.Several of the more developed of the N-11 countries, in particular Turkey, Mexico, Indonesia and Nigeria, are seen as the most likely contenders to the BRICs. Some other developing countries that have not yet reached the N-11 economic level, such as South Africa, aspire to BRIC status. Economists at the Reuters 2011 Investment Outlook Summit, held on 6–7 December 2010, dismissed the notion of South Africa joining BRIC.[6] Jim O'Neill told the summit that he was constantly being lobbied about BRIC status by various countries. He said that South Africa, at a population of under 50 million people, was just too small an economy to join the BRIC ranks.[7] However, after the BRIC countries formed a political organization among themselves, they later expanded to include South Africa, becoming the BRICS.[8]Goldman Sachs has argued that, since the four BRIC countries are developing rapidly, by 2050 their combined economies could eclipse the combined economies of the current richest countries of the world. These four countries, combined, currently account for more than a quarter of the world's land area and more than 40% of the world's population.[9][10]Goldman Sachs did not argue that the BRICs would organize themselves into an economic bloc, or a formal trading association, as the European Union has done.[11] However, there are some indications that the "four BRIC countries have been seeking to form a 'political club' or 'alliance'", and thereby converting "their growing economic power into greater geopolitical clout".[12][13] On June 16, 2009, the leaders of the BRIC countries held their first summit in Yekaterinburg, and issued a declaration calling for the establishment of an equitable, democratic and multipolar world order. Since then they have met in Brasília in 2010, met in Sanya in 2011 and in New Delhi, India in 2012.[14]

Contents

[hide][edit] Thesis

Economist Jim O'Neill who proposed the idea of BRIC countries.São Paulo, BrazilShanghai, ChinaMumbai, IndiaGoldman Sachs argues that the economic potential of Brazil, Russia, India and China is such that they could become among the four most dominant economies by the year 2050. The thesis was proposed by Jim O'Neill, global economist at Goldman Sachs.[15] These countries encompass over 25% of the world's land coverage and 40% of the world's population and hold a combined GDP (PPP) of 18.486 trillion dollars. On almost every scale, they would be the largest entity on the global stage. These four countries are among the biggest and fastest growing emerging markets.{Incal 2011}However, it is not the intent of Goldman Sachs to argue that these four countries are a political alliance (such as the European Union) or any formal trading association, like ASEAN. Nevertheless, they have taken steps to increase their political cooperation, mainly as a way of influencing the United States position on major trade accords, or, through the implicit threat of political cooperation, as a way of extracting political concessions from the United States, such as the proposed nuclear cooperation with India.[citation needed]

Economist Jim O'Neill who proposed the idea of BRIC countries.São Paulo, BrazilShanghai, ChinaMumbai, IndiaGoldman Sachs argues that the economic potential of Brazil, Russia, India and China is such that they could become among the four most dominant economies by the year 2050. The thesis was proposed by Jim O'Neill, global economist at Goldman Sachs.[15] These countries encompass over 25% of the world's land coverage and 40% of the world's population and hold a combined GDP (PPP) of 18.486 trillion dollars. On almost every scale, they would be the largest entity on the global stage. These four countries are among the biggest and fastest growing emerging markets.{Incal 2011}However, it is not the intent of Goldman Sachs to argue that these four countries are a political alliance (such as the European Union) or any formal trading association, like ASEAN. Nevertheless, they have taken steps to increase their political cooperation, mainly as a way of influencing the United States position on major trade accords, or, through the implicit threat of political cooperation, as a way of extracting political concessions from the United States, such as the proposed nuclear cooperation with India.[citation needed][edit] (2003) Dreaming with BRICs: The Path to 2050

The BRIC thesis recognizes that Brazil, Russia, India and China[16] have changed their political systems to embrace global capitalism. Goldman Sachs predicts that China and India, respectively, will become the dominant global suppliers of manufactured goods and services, while Brazil and Russia will become similarly dominant as suppliers of raw materials. Of the four countries, Brazil remains the only polity that has the capacity to continue all elements, meaning manufacturing, services, and resource supplying simultaneously. Cooperation is thus hypothesized to be a logical next step among the BRICs because Brazil and Russia together form the logical commodity suppliers.[edit] (2004) Follow-up report

The Goldman Sachs global economics team released a follow-up report to its initial BRIC study in 2004.[17] The report states that in BRIC nations, the number of people with an annual income over a threshold of $3,000, will double in number within three years and reach 800 million people within a decade. This predicts a massive rise in the size of the middle class in these nations. In 2025, it is calculated that the number of people in BRIC nations earning over $15,000 may reach over 200 million. This indicates that a huge pickup in demand will not be restricted to basic goods but impact higher-priced goods as well. According to the report, first China and then a decade later India will begin to dominate the world economy.Yet despite the balance of growth, swinging so decisively towards the BRIC economies, the average wealth level of individuals in the more advanced economies will continue to far outstrip the BRIC economic average.The report also highlights India's great inefficiency in energy use and mentions the dramatic under-representation of these economies in the global capital markets. The report also emphasizes the enormous populations that exist within the BRIC nations, which makes it relatively easy for their aggregate wealth to eclipse the G6, while per-capita income levels remain far below the norm of today's industrialized countries. This phenomenon, too, will affect world markets as multinational corporations will attempt to take advantage of the enormous potential markets in the BRICs by producing, for example, far cheaper automobiles and other manufactured goods affordable to the consumers within the BRICs in lieu of the luxury models that currently bring the most income to automobile manufacturers. India and China have already started making their presence felt in the service and manufacturing sector respectively in the global arena. Developed economies of the world have already taken serious note of this fact.[edit] (2007) Second Follow-up report

This report compiled by lead authors Tushar Poddar and Eva Yi gives insight into "India's Rising Growth Potential". It reveals updated projection figures attributed to the rising growth trends in India over the last four years. Goldman Sachs assert that "India's influence on the world economy will be bigger and quicker than implied in our previously published BRICs research". They noted significant areas of research and development, and expansion that is happening in the country, which will lead to the prosperity of the growing middle-class.[18]India has 10 of the 30 fastest-growing urban areas in the world and, based on current trends, we estimate a massive 700 million people will move to cities by 2050. This will have significant implications for demand for urban infrastructure, real estate, and services.—[18]In the revised 2007 figures, based on increased and sustaining growth, more inflows into foreign direct investment, Goldman Sachs predicts that "from 2007 to 2020, India's GDP per capita in US$ terms will quadruple", and that the Indian economy will surpass the United States (in US$) by 2043.[18][edit] (2010) EM Equity in Two Decades: A Changing Landscape

According to a 2010 report from Goldman Sachs, China might surpass the US in equity market capitalization terms by 2030 and become the single largest equity market in the world.[19] By 2020, America's GDP might be only slightly larger than China's GDP. Together, the four BRICs may account for 41% of the world's market capitalization by 2030, the report said.[20]In late 2010, China surpassed Japan's GDP for the first time, with China's GDP standing at $5.88 trillion compared to Japan's $5.47 trillion. China thus became the world's second-largest economy after the United States.[21]Based on a Forbes report released in March 2011, the BRIC countries numbered 301 billionaires among their combined populations, exceeding the number of billionaires in Europe, which stood at 300 in 2011.[22]According to The National Institute of Economic and Social Research (NIESR) based on International Monetary Fund figures, in 2012 Brazil has become the sixth-biggest economy in the world by overtaking UK with $2.52 trillion and $2.48 trillion, respectively. In 2010, the Brazillian economy was worth $2.09 trillion and UK with $2.25 trillion. Significant increase is caused by Brazillian economic boom on high food and oil prices.[23]After Standard & Poor's (S&P) cited that India's growth outlook could deteriorate if policymaking and governance don't improve, in June 2012 Fitch Ratings cut its credit outlook to negative from stable with maintained its BBB- rating, the lowest investment grade rating. A week before Fitch released the rating, S&P said India could become the first of the BRIC countries, to lose investment-grade status.[24][edit] Statistics

Proportion of world (countries with data) nominal GDP for the countries with the top 10 highest nominal GDP in 2010, from 1980 to 2010 with IMF projections until 2016. Countries marked with an asterisk are non-G8 countries China, Brazil and India. Grey lines show actual US dollar values.[25]The Economist publishes an annual table of socio-economic national statistics in its Pocket World in Figures.[citation needed] Extrapolating the global rankings from their 2008 Edition for the BRIC countries and economies in relation to various categories provides an interesting touchstone in relation to the economic underpinnings of the BRIC thesis. It also illustrates how, despite their divergent economic bases, the economic indicators are remarkably similar in global rankings between the different economies. It also suggests that, while economic arguments can be made for linking Mexico into the BRIC thesis, the case for including South Korea looks considerably weaker.A Goldman Sachs paper published later in December 2005 explained why Mexico was not included in the original BRICs.[5]

Proportion of world (countries with data) nominal GDP for the countries with the top 10 highest nominal GDP in 2010, from 1980 to 2010 with IMF projections until 2016. Countries marked with an asterisk are non-G8 countries China, Brazil and India. Grey lines show actual US dollar values.[25]The Economist publishes an annual table of socio-economic national statistics in its Pocket World in Figures.[citation needed] Extrapolating the global rankings from their 2008 Edition for the BRIC countries and economies in relation to various categories provides an interesting touchstone in relation to the economic underpinnings of the BRIC thesis. It also illustrates how, despite their divergent economic bases, the economic indicators are remarkably similar in global rankings between the different economies. It also suggests that, while economic arguments can be made for linking Mexico into the BRIC thesis, the case for including South Korea looks considerably weaker.A Goldman Sachs paper published later in December 2005 explained why Mexico was not included in the original BRICs.[5]

Statistics Categories Brazil Russia India China Area 005th 001st 007th 003rd Population 005th 009th 002nd 001st Population growth rate 107th 221st 090th 156th Labour force 005th 007th 002nd 001st GDP (nominal) 007th 011th 09th 002nd GDP (PPP) 007th 006th 003rd 002nd GDP (nominal) per capita 055th 054th 137th 095th GDP (PPP) per capita 071st 051st 127th 093rd GDP (real) growth rate 015th 088th 005th 006th Human Development Index 073rd 065th 119th 089th Exports 018th 09th 014th 001st Imports 019th 017th 011th 002nd Current account balance 047th 005th 169th 001st Received FDI 011th 012th 029th 005th Foreign exchange reserves 007th 003rd 006th 001st External debt 028th 024th 026th 023rd Public debt 047th 122nd 029th 098th Electricity consumption 009th 004th 003rd 002nd Renewable energy source 003rd 005th 006th 001st Number of mobile phones 005th 004th 002nd 001st Number of internet users 005th 007th 004th 001st Motor vehicle production 007th 019th 006th 001st Military expenditures 012th 005th 010th 002nd Active troops 014th 005th 003rd 001st Rail network 010th 002nd 004th 003rd Road network 004th 008th 003rd 002nd  The ten largest economies in the world in 2050, measured in GDP (billions of 2006 USD), according to Goldman Sachs[26]

The ten largest economies in the world in 2050, measured in GDP (billions of 2006 USD), according to Goldman Sachs[26]

Gross Domestic Product in 2006 US$ billions[26] Rank 2050 Country 2050 2045 2040 2035 2030 2025 2020 2015 2010 2006 1 China 70,710 57,310 45,022 34,348 25,610 18,437 12,630 8,133 4,667 2,682 2 United States 38,514 33,904 29,823 26,097 22,817 20,087 17,978 16,194 14,535 13,245 3 India 37,668 25,278 16,510 10,514 6,683 4,316 2,848 1,900 1,256 909 4 Brazil 11,366 8,740 6,631 4,963 3,720 2,831 2,194 1,720 2,087 1,064 5 Mexico 9,340 7,204 5,471 4,102 3,068 2,303 1,742 1,327 1,009 851 6 Russia 8,580 7,420 6,320 5,265 4,265 3,341 2,554 1,900 1,371 982 7 Indonesia 7,010 4,846 3,286 2,192 1,479 1,033 752 562 419 350 8 Japan 6,677 6,300 6,042 5,886 5,814 5,570 5,224 4,861 4,604 4,336 9 United Kingdom 5,133 4,744 4,344 3,937 3,595 3,333 3,101 2,835 2,546 2,310 10 Germany 5,024 4,714 4,388 4,048 3,761 3,631 3,519 3,326 3,083 2,851 11 Nigeria 4,640 2,870 1,765 1,083 680 445 306 218 158 121 12 France 4,592 4,227 3,892 3,567 3,306 3,055 2,815 2,577 2,366 2,194 13 South Korea 4,083 3,562 3,089 2,644 2,241 1,861 1,508 1,305 1,071 887 14 Turkey 3,943 3,033 2,300 1,716 1,279 965 740 572 440 390 15 Vietnam 3,607 2,569 1,768 1,169 745 458 273 157 88 55 16 Canada 3,149 2,849 2,569 2,302 2,061 1,856 1,700 1,549 1,389 1,260 17 Pakistan 3,070 2,085 1,472 1,026 709 497 359 268 161 129 18 Philippines 3,010 2,040 1,353 882 582 400 289 215 162 117 19 Italy 2,950 2,737 2,559 2,444 2,391 2,326 2,224 2,072 1,914 1,809 20 Iran 2,663 2,133 1,673 1,273 953 716 544 415 312 245 21 Egypt 2,602 1,728 1,124 718 467 318 229 171 129 101 22 Bangladesh 1,466 1,001 676 451 304 210 150 110 81 63

Gross Domestic Product per capita (real)[26] Rank 2050 Country 2050 2045 2040 2035 2030 2025 2020 2015 2010 2006 Percent growth from 2006 to 2050 1 United States 91,683 83,489 76,044 69,019 62,717 57,446 53,502 50,200 47,014 44,379 206% 2 South Korea 90,294 75,979 63,924 53,449 44,602 36,813 29,868 26,012 21,602 18,161 497% 3 United Kingdom 79,234 73,807 67,391 61,049 55,904 52,220 49,173 45,591 41,543 38,108 207% 4 Russia 78,435 65,708 54,221 43,800 34,368 26,061 19,311 13,971 9,833 6,909 1,137% 5 Canada 76,002 69,531 63,464 57,728 52,663 48,621 45,961 43,449 40,541 38,071 199% 6 France 75,253 68,252 62,136 56,562 52,327 48,429 44,811 41,332 38,380 36,045 208% 7 Germany 68,253 62,658 57,118 51,710 47,263 45,033 43,223 40,589 37,474 34,588 197% 8 Japan 66,846 60,492 55,756 52,345 49,975 46,419 42,385 38,650 36,194 34,021 196% 9 Mexico 63,149 49,393 38,255 29,417 22,694 17,685 13,979 11,176 8,972 7,918 797% 10 Italy 58,545 52,760 48,070 44,948 43,195 41,358 38,990 35,908 32,948 31,123 188% 11 Brazil 49,759 38,149 29,026 21,924 16,694 12,996 10,375 8,427 6,882 5,657 879% 12 China 49,650 39,719 30,951 23,511 17,522 12,688 8,829 5,837 3,463 2,041 2,432% 13 Turkey 45,595 34,971 26,602 20,046 15,188 11,743 9,291 7,460 6,005 5,545 822% 14 Vietnam 33,472 23,932 16,623 11,148 7,245 4,583 2,834 1,707 1,001 655 5,110% 15 Iran 32,676 26,231 20,746 15,979 12,139 9,328 7,345 5,888 4,652 3,768 867% 16 Indonesia 22,395 15,642 10,784 7,365 5,123 3,711 2,813 2,197 1,724 1,508 1,485% 17 India 20,836 14,446 9,802 6,524 4,360 2,979 2,091 1,492 1,061 817 2,550% 18 Pakistan 20,500 14,025 9,443 6,287 4,287 3,080 2,352 1,880 1,531 1,281 1,600% 19 Philippines 20,388 14,260 9,815 6,678 4,635 3,372 2,591 2,075 1,688 1,312 1,553% 20 Nigeria 13,014 8,934 6,117 4,191 2,944 2,161 1,665 1,332 1,087 919 1,416% 21 Egypt 11,786 7,066 5,183 3,775 2,744 2,035 1,568 1,260 897 778 908% 22 Bangladesh 5,235 3,767 2,698 1,917 1,384 1,027 790 627 510 427 1,225%

Gross Domestic Product in 2006 US$ billions [26] Groups Countries 2050 2045 2040 2035 2030 2025 2020 2015 2010 2006 BRIC Brazil, Russia, India, China 128,324 98,757 74,483 55,090 40,278 28,925 20,226 13,653 8,640 5,637 G7 Canada, France, Germany, Italy, Japan, United Kingdom, USA 66,039 59,475 53,617 48,281 43,745 39,858 36,781 33,414 30,437 28,005 The following three tables are lists of economies by incremental GDP from 2006 to 2050 by Goldman Sachs. They illustrate that the BRICs and N11 nations are replacing G7 nations as the main contributors to world's economic growth. From 2020 to 2050, nine of the ten largest countries by incremental GDP are occupied by the BRICs and N11 nations, in which the United States remains to be the only G7 member as one of the three biggest contributors to the global economic growth.[26]

List of Economies by Incremental Nominal GDP from 2006 to 2020 Rank Country Incremental GDP in billions of 2006 US$ 1 China 9,948 2 United States 4,733 3 India 1,939 4 Russia 1,572 5 Brazil 1,130 6 Mexico 891 7 Japan 888 8 United Kingdom 791 9 Germany 668 10 Italy 635 11 France 621 11 South Korea 621 13 Canada 440 14 Indonesia 402 15 Turkey 350 16 Iran 299 17 Vietnam 218 18 Nigeria 185 19 Philippines 172 20 Pakistan 139 21 Egypt 128 22 Bangladesh 87

List of Economies by Incremental Nominal GDP from 2020 to 2035 Rank Country Incremental GDP in billions of 2006 US$ 1 China 21,718 2 United States 8,119 3 India 7,666 4 Brazil 2,769 5 Russia 2,711 6 Mexico 2,360 7 Indonesia 1,440 8 South Korea 1,136 9 Turkey 976 10 Vietnam 896 11 United Kingdom 836 12 Nigeria 777 13 France 752 14 Iran 729 15 Japan 662 16 Canada 602 17 Philippines 593 18 Germany 529 18 Egypt 502 20 Pakistan 441 21 Bangladesh 301 22 Italy 220

List of Economies by Incremental Nominal GDP from 2035 to 2050 Rank Country Incremental GDP in billions of 2006 US$ 1 China 36,362 2 India 27,154 3 United States 12,417 4 Brazil 6,403 5 Mexico 5,238 6 Indonesia 4,818 7 Nigeria 3,557 8 Russia 3,315 9 Vietnam 2,438 10 Turkey 2,227 11 Philippines 2,128 12 Egypt 1,884 13 South Korea 1,439 14 Iran 1,390 15 Pakistan 1,376 16 United Kingdom 1,196 17 France 1,025 18 Bangladesh 1,015 19 Germany 976 20 Canada 847 21 Japan 791 22 Italy 506 At World Economic Forum 2011, there are 365 corporate executives from BRIC and other emerging nations out of 1000 participants. It is a record number of executives from emerging markets. Nomura Holdings Inc's co-head of global investment banking said that "It's a reflection of where economic power and influence is starting to move." The International Monetary Fund estimates emerging markets may expand 6.5 percent in 2011, more than double the 2.5 percent rate for developed countries. BRIC's takeover made record by 22 percent of global deals or increase by 74 percent in one year and more than quadruple in the last five years.[27][edit] History

Various sources refer to a purported "original" BRIC agreement that predates the Goldman Sachs thesis. Some of these sources claim that President Vladimir Putin of Russia was the driving force behind this original cooperative coalition of developing BRIC countries. However, thus far, no text has been made public of any formal agreement to which all four BRIC states are signatories. This does not mean, however, that they have not reached a multitude of bilateral or even quadrilateral agreements. Evidence of agreements of this type are abundant and are available on the foreign ministry websites of each of the four countries. Trilateral agreements and frameworks made among the BRICs include the Shanghai Cooperation Organization (member states include Russia and China, observers include India) and the IBSA Trilateral Forum, which unites Brazil, India, and South Africa in annual dialogues. Also important to note is the G-20 coalition of developing states which includes all the BRICs.Also, because of the popularity of the Goldman Sachs thesis "BRIC", this term has sometimes been extended whereby "BRICK"[28][29] (K for South Korea), "BRIMC"[30][31] (M for Mexico), "BRICA" (GCC Arab countries – Saudi Arabia, Qatar, Kuwait, Bahrain, Oman and the United Arab Emirates)[32] and "BRICET" (including Eastern Europe and Turkey)[33] have become more generic marketing terms to refer to these emerging markets.In an August 2010 op-ed, Jim O'Neill of Goldman Sachs argued that Africa could be considered the next BRIC.[34] Analysts from rival banks have sought to move beyond the BRIC concept, by introducing their own groupings of emerging markets. Proposals include CIVETs (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa), the EAGLES (Emerging and Growth-Leading Economies) and the 7 per cent Club (which includes those countries which have averaged economic growth of at least 7 per cent a year).[35]South Africa sought BRIC membership since 2009 and the process for formal admission began as early as August 2010.[36] South Africa was officially admitted as a BRIC nation on December 24, 2010 after being invited by China and the other BRIC countries to join the group.[37] The capital "S" in BRICS stands for South Africa. President Jacob Zuma attend the BRICS summit in Sanya in April 2011 as a full member. South Africa stands at a unique position to influence African economic growth and investment. According to Jim O'neill of Goldman Sachs who originally coined the term, Africa's combined current gross domestic product is reasonably similar to that of Brazil and Russia, and slightly above that of India.[38] South Africa is a "gateway" to Southern Africa and Africa in general as the most developed African country.[38] China is South Africa's largest trading partner, and India wants to increase commercial ties to Africa.[36] South Africa is also Africa's largest economy, but as number 31 in global GDP economies it is far behind its new partners.[36]Jim O'Neill expressed surprise when South Africa joined BRIC since South Africa's economy is a quarter of the size of Russia's (the least economically powerful BRIC nation).[39] He believed that the potential was there but did not anticipate inclusion of South Africa at this stage.[38] Martyn Davies, a South African emerging markets expert, argued that the decision to invite South Africa made little commercial sense but was politically astute given China's attempts to establish a foothold in Africa. Further, South Africa's inclusion in BRICS may translate to greater South African support for China in global fora.[39]African credentials are important geopolitically, giving BRICS a four-continent breadth, influence and trade opportunities.[36] South Africa's addition is a deft political move that further enhances BRICS' power and status.[36] In the original essay that coined the term, Goldman Sachs did not argue that the BRICs would organize themselves into an economic bloc, or a formal trading association which this move signifies.[citation needed][edit] Marketing

The São Paulo Stock Exchange is the third-largest exchange operator by market value in the world.[40]The BRIC term is also used by companies who refer to the four named countries as key to their emerging markets strategies. By comparison the reduced acronym IC would not be attractive, although the term "Chindia" is often used. The BRIC's study specifically focuses on large countries, not necessarily the wealthiest or the most productive and was never intended to be an investment thesis. If investors read the Goldman's research carefully, and agreed with the conclusions, then they would gain exposure to Asian debt and equity markets rather than to Latin America. According to estimates provided by the USDA, the wealthiest regions outside of the G6 in 2015 will be Hong Kong, South Korea and Singapore. Combined with China and India, these five economies are likely to be the world's five most influential economies outside of the G6.On the other hand, when the "R" in BRIC is extended beyond Russia and is used as a loose term to include all of Eastern Europe as well, then the BRIC story becomes more compelling. At issue are the multiple serious problems which confront Russia (potentially unstable government, environmental degradation, critical lack of modern infrastructure, etc.[citation needed]), and the comparatively much lower growth rate seen in Brazil. However, Brazil's lower growth rate obscures the fact that the country is wealthier than China or India on a per-capita basis, has a more developed and global integrated financial system and has an economy potentially more diverse than the other BRICs due to its raw material and manufacturing potential. Many other Eastern European countries, such as Poland, Romania, the Czech Republic, Slovakia, Hungary, Bulgaria, and several others were able to continually sustain high economic growth rates and do not experience some of the problems that Russia experiences or experience them to a lesser extent. In terms of GDP per capita in 2008, Brazil ranked 64th, Russia 42nd, India 113th and China 89th. By comparison South Korea ranked 24th and Singapore 3rd.Brazil's stock market, the Bovespa, has gone from approximately 9,000 in September 2002 to over 70,000 in May 2008. Government policies have favored investment (lowering interest rates), retiring foreign debt and expanding growth, and a reformulation of the tax system is being voted in the congress. The British author and researcher Mark Kobayashi-Hillary wrote a book in 2007 titled 'Building a Future with BRICs' for European publisher Springer Verlag that examines the growth of the BRICs region and its effect on global sourcing. Contributors to the book include Nandan Nilekani, and Shiv Nadar.

The São Paulo Stock Exchange is the third-largest exchange operator by market value in the world.[40]The BRIC term is also used by companies who refer to the four named countries as key to their emerging markets strategies. By comparison the reduced acronym IC would not be attractive, although the term "Chindia" is often used. The BRIC's study specifically focuses on large countries, not necessarily the wealthiest or the most productive and was never intended to be an investment thesis. If investors read the Goldman's research carefully, and agreed with the conclusions, then they would gain exposure to Asian debt and equity markets rather than to Latin America. According to estimates provided by the USDA, the wealthiest regions outside of the G6 in 2015 will be Hong Kong, South Korea and Singapore. Combined with China and India, these five economies are likely to be the world's five most influential economies outside of the G6.On the other hand, when the "R" in BRIC is extended beyond Russia and is used as a loose term to include all of Eastern Europe as well, then the BRIC story becomes more compelling. At issue are the multiple serious problems which confront Russia (potentially unstable government, environmental degradation, critical lack of modern infrastructure, etc.[citation needed]), and the comparatively much lower growth rate seen in Brazil. However, Brazil's lower growth rate obscures the fact that the country is wealthier than China or India on a per-capita basis, has a more developed and global integrated financial system and has an economy potentially more diverse than the other BRICs due to its raw material and manufacturing potential. Many other Eastern European countries, such as Poland, Romania, the Czech Republic, Slovakia, Hungary, Bulgaria, and several others were able to continually sustain high economic growth rates and do not experience some of the problems that Russia experiences or experience them to a lesser extent. In terms of GDP per capita in 2008, Brazil ranked 64th, Russia 42nd, India 113th and China 89th. By comparison South Korea ranked 24th and Singapore 3rd.Brazil's stock market, the Bovespa, has gone from approximately 9,000 in September 2002 to over 70,000 in May 2008. Government policies have favored investment (lowering interest rates), retiring foreign debt and expanding growth, and a reformulation of the tax system is being voted in the congress. The British author and researcher Mark Kobayashi-Hillary wrote a book in 2007 titled 'Building a Future with BRICs' for European publisher Springer Verlag that examines the growth of the BRICs region and its effect on global sourcing. Contributors to the book include Nandan Nilekani, and Shiv Nadar.[edit] International Law

Brazilian lawyer and author Adler Martins has published a paper called "Contratos Internacionais entre os países do BRIC"[41] (International Agreements Among BRIC countries) which highlights the international conventions ratified by the BRIC countries, which allow them to maintain trade and investment activities safely within the group. Mr. Martin's study is being further developed by the Federal University of the Minas Gerais State, in Brazil.[edit] Financial diversification

It has been argued that geographic diversification would eventually generate superior risk-adjusted returns for long-term global investors by reducing overall portfolio risk while capturing some of the higher rates of return offered by the emerging markets of Asia, Eastern Europe and Latin America.[42] By doing so, these institutional investors have contributed to the financial and economic development of key emerging nations such as Brazil, India, China, and Russia. For global investors, India and China constitute both large-scale production platforms and reservoirs of new consumers, whereas Russia is viewed essentially as an exporter of oil and commodities- Brazil and Latin America being somehow "in the middle".[edit] Criticism

A criticism is that the BRIC projections are based on the assumptions that resources are limitless and endlessly available when needed. In reality, many important resources currently necessary to sustain economic growth, such as oil, natural gas, coal, other fossil fuels, and uranium might soon experience a peak in production before enough renewable energy can be developed and commercialized, which might result in slower economic growth than anticipated, thus throwing off the projections and their dates. The economic emergence of the BRICs will have unpredictable consequences for the global environment. Indeed, proponents of a set carrying capacity for the Earth may argue that, given current technology, there is a finite limit to how much the BRICs can develop before exceeding the ability of the global economy to supply.[43]Academics and experts have suggested that China is in a league of its own compared to the other BRIC countries.[44] As David Rothkopf wrote in Foreign Policy, "Without China, the BRICs are just the BRI, a bland, soft cheese that is primarily known for the whine [sic] that goes with it. China is the muscle of the group and the Chinese know it. They have effective veto power over any BRIC initiatives because without them, who cares really? They are the one with the big reserves. They are the biggest potential market. They are the U.S. partner in the G2 (imagine the coverage a G2 meeting gets vs. a G8 meeting) and the E2 (no climate deal without them) and so on."[45] Deutsche Bank Research said in a report that "economically, financially and politically, China overshadows and will continue to overshadow the other BRICs." It added that China's economy is larger than that of the three other BRIC economies (Brazil, Russia and India) combined. Moreover, China's exports and its official foreign-exchange reserves are more than twice as large as those of the other BRICs combined.[46] In that perspective, some pension investment experts have argued that "China alone accounts for more than 70% of the combined GDP growth generated by the BRIC countries [from 1999 to 2010]: if there is a BRIC miracle it's first and foremost a Chinese one".[47] The "growth gap" between China and other large emerging economies such as Brazil, Russia and India can be attributed to a large extent to China's early focus on ambitious infrastructure projects: while China invested roughly 9% of its GDP on infrastructure in the 1990s and 2000s, most emerging economies invested only 2% to 5% of their GDP. This considerable spending gap allowed the Chinese economy to grow at near optimal conditions while many South American and South Asian economies suffered from various development bottlenecks (poor transportation networks, aging power grids, mediocre schools...).[48]The preeminence of China and India as major manufacturing countries with unrealised potential has been widely recognised, but some commentators state that China's and Russia's large-scale disregard for human rights and democracy could be a problem in the future. Human rights issues do not inform the foreign policies of these two countries to the same extent as they do the policies of other large states such as Japan, India, the EU states and the USA. There is also the possibility of conflict over Taiwan in the case of China.There is also the issue of population growth. The population of Russia has been declining rapidly in the 1990s and only recently did the Russian government predict the population to stabilize and grow in 2020. Brazil's and China's populations will begin to decline in several decades[citation needed], with their demographic windows closing in several decades as well. This may have implications for those countries' future, for there might be a decrease in the overall labor force and a negative change in the proportion of workers to retirees.Brazil's economic potential has been anticipated for decades, but it had until recently consistently failed to achieve investor expectations.[citation needed] Only in recent years has the country established a framework of political, economic, and social policies that allowed it to resume consistent growth. The result has been solid and paced economic development that rival its early 70's "miracle years", as reflected in its expanding capital markets, lowest unemployment rates in decades, and consistent international trade surpluses - that led to the accumulation of reserves and liquidation of foreign debt (earning the country a coveted investment grade by the S&P and Fitch Ratings in 2008).Finally, India's relations with its neighbor Pakistan have always been tense. In 1998, there was a nuclear standoff between Pakistan and India.[49] Border conflicts with Pakistan, mostly over the long held dispute over Kashmir, has further aggravated any economic ties. This impedes progress by limiting government finances, increasing social unrest, and limiting potential domestic economic demand. Factors such as international conflict, civil unrest, unwise political policy, outbreaks of disease and terrorism are all factors that are difficult to predict and that could have an effect on the destiny of any country.Other critics suggest that BRIC is nothing more than a neat acronym for the four largest emerging market economies,[citation needed] but in economic and political terms nothing else (apart from the fact that they are all big emerging markets) links the four. Two are manufacturing based economies and big importers (China and India), but two are huge exporters of natural resources (Brazil and Russia). The Economist, in its special report on Brazil, expressed the following view: "In some ways Brazil is the steadiest of the BRICs. Unlike China and Russia it is a full-blooded democracy; unlike India it has no serious disputes with its neighbors. It is the only BRIC without a nuclear bomb." The Heritage Foundation's "Economic Freedom Index", which measures factors such as protection of property rights and free trade ranks Brazil ("moderately free") above the other BRICs ("mostly unfree").[50] Henry Kissinger has stated that the BRIC nations have no hope of acting together as a coherent bloc in world affairs, and that any cooperation will be the result of forces acting on the individual nations.[citation needed]It is also noticed that BRIC countries have undermined qualitative factors that is reflected in deterioration in Doing Business ranking 2010 and other several human indexes.[51]In a not-so-subtle dig critical of the term as nothing more than a shorthand for emerging markets generally, critics have suggested a correlating term, CEMENT (Countries in Emerging Markets Excluded by New Terminology). Whilst they accept there has been spectacular growth of the BRIC economies, these gains have largely been the result of the strength of emerging markets generally, and that strength comes through having BRICs and CEMENT.[52][edit] Proposed inclusions